Nebula

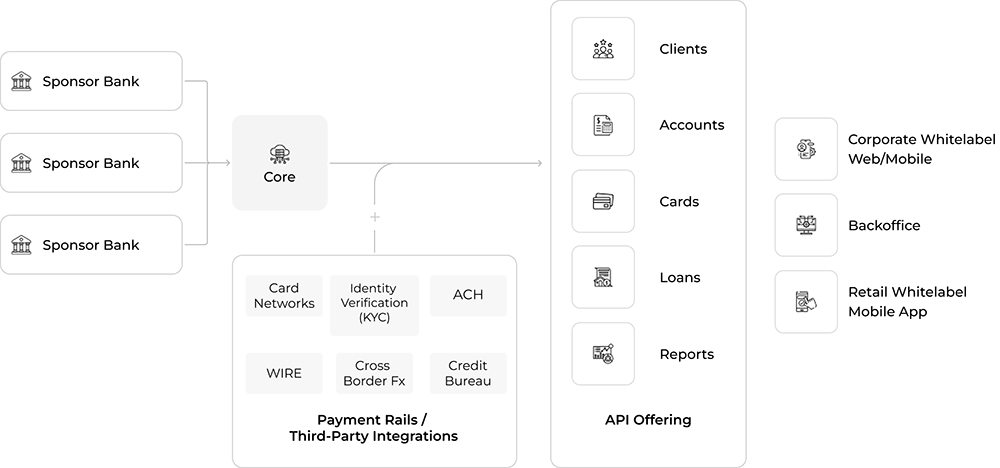

Embark on a transformative journey with Mbanq Nebula:

core technology, APIs, and frontend apps all in one

Full scope of banking products and services

Client-facing desktop & mobile apps included

Integrated back office that simplifies Ops

Easily scalable and powered by AWS cloud

All-Inclusive & Modular Platform for Banks That Adapt Fast

Operate with Confidence

in Nebula’s Robust Functionalities

Deposit Accounts

Cards

Loans

Payment Rails

Client Management

Save Six Figures on Mobile App Development

with Our White-Label Apps

A One-of-a-Kind Core + Frontends Combo

Streamlines GTM Strategy

Saves months of development, speeds go-to-market timeline, significantly cuts costs

Complete Banking Suite

Our app covers all banking needs with card management, transaction history, and KYC/KYB widgets.

Integration Made Easy

Save time with a fully integrated, core-compatible solution ready to use.

User-Centric

Enhance your brand with seamless banking: easy login, account management, and advanced transfers.

Portfolio of Support Services

Everything you need to create and operate a digital bank

Regulatory and Compliance

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Operations

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Dispute Resolutions

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Complaints

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Contact Center

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.

Ready to Redefine Digital Banking?

Partner with Mbanq for comprehensive, scalable financial solutions tailored to your business goals. Share a few details about your vision, and our team will reach out promptly to explore how we can help you succeed.